Will the Federal Reserve Cut Interest Rates? A Deep Dive into the September Decision

The Federal Reserve is widely expected to cut interest rates at its upcoming meeting this September, a move driven by concerns about the weakening labor market. However, with inflation still above the Fed's 2% target, the extent and frequency of future rate cuts remain uncertain. The decision comes amid economic uncertainty and political pressure from the Trump administration.

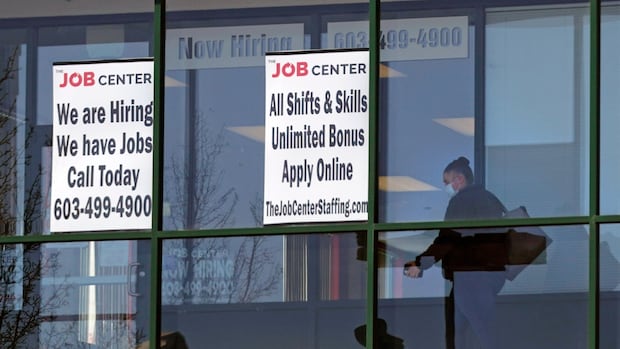

The Pressure to Cut Rates: A Weakening Labor Market

Recent economic data points to a concerning trend in the labor market. The U.S. economy added only 22,000 jobs in August, and revisions revealed job losses in June. The unemployment rate has also risen, signaling a potential slowdown in hiring. Kathy Bostjancic, Chief Economist at Nationwide, noted that this "dramatic stall in hiring" supports the Fed's move to cut rates.

- August saw disappointing job growth figures.

- Revisions indicated job losses in June.

- The unemployment rate increased.

The Inflation Dilemma: Balancing Growth and Price Stability

The Federal Reserve is tasked with maintaining maximum employment and low inflation. Cutting interest rates can stimulate the economy by making borrowing cheaper, but it can also fuel inflation. The Fed's dilemma is that inflation, while moderating, remains above its 2% target. Consumer prices increased by 2.9% in August, and core inflation held steady at 3.1%.

Political Pressure and Internal Disagreement

The Fed's decision is further complicated by political pressure from President Donald Trump, who has repeatedly called for lower rates. Additionally, there is potential for internal disagreement among Fed officials. Some, like Republican Fed Governors Christopher Waller and Michelle Bowman, might advocate for a more aggressive 0.5 percentage point cut, while others may oppose any cuts at all, citing concerns about inflation.

"This decision is unlikely to be unanimous," said Matthew Luzzetti, Deutsche Bank Research economist. "Depending on the outcome, it could be the first meeting where three governors dissent since 1988 and the first with dissents on both sides since September 2019."

What to Expect from the September Meeting

Investors are largely anticipating a rate cut this month. CME's FedWatch tool indicates a high probability of a 25 basis point cut. However, the extent of future cuts remains uncertain. While markets anticipate three rate cuts in 2025, economists are divided on whether the Fed will announce two or three reductions this year. The presence and role of Lisa Cook, whose position is being challenged by the Trump administration, also adds an element of uncertainty to the meeting.

Ultimately, the Fed's decision hinges on balancing the risks of a slowing economy with the need to keep inflation in check, all while navigating political pressures and internal disagreements.

Visit the website

Visit the website