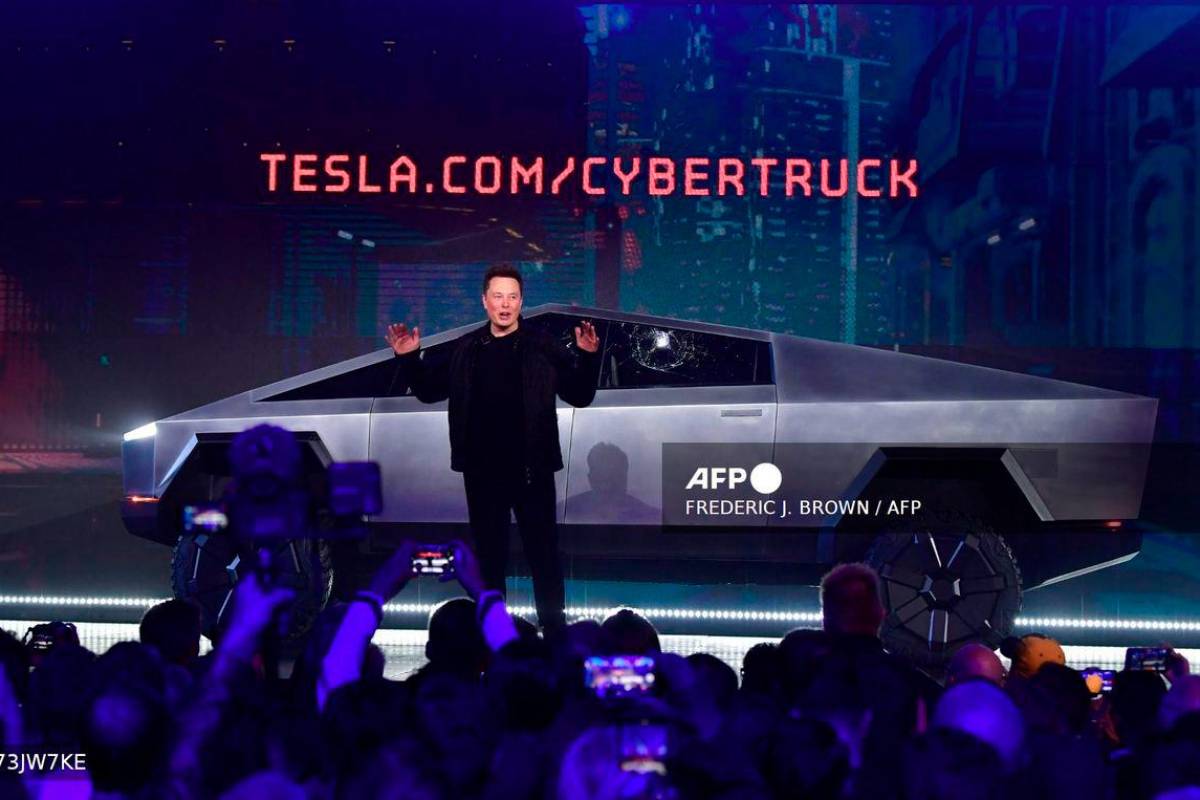

Tesla Board Chair Defends Elon Musk's Proposed Trillion-Dollar Pay Package

The chair of Tesla's board of directors, Robyn Denholm, has defended the proposed compensation package for CEO Elon Musk, which could be the largest in corporate history. This defense comes despite recent struggles at Tesla, including sinking sales, profit, and a new product launch perceived as unsuccessful. The plan, unveiled in a regulatory filing last week, will be voted on by shareholders at the annual meeting in November.

Justification for the Compensation Plan

In an interview with The New York Times, Ms. Denholm emphasized the need to motivate Mr. Musk with seemingly impossible goals to unlock his potential for delivering world-changing technology. She stated, "Putting together any compensation plan, you need to look at what motivates the individual that you’re trying to motivate. And for Elon, it’s doing things that no one else has done before." The discussion took place at Tesla's engineering headquarters in Palo Alto, Calif.

Tesla argues that the massive share award, potentially worth $1 trillion, is necessary to compete with Musk's other ventures, primarily SpaceX and xAI Holdings. The company fears that without this incentive, Musk will prioritize these other companies, which now constitute the majority of his wealth.

Musk's Diversified Wealth Portfolio

A recent proxy filing by Tesla reveals that a significant portion of Elon Musk's wealth is now derived from his private companies. The filing highlights the need to incentivize Musk to prevent him from "prioritizing other ventures." The proposed pay package involves up to 423 million shares.

While estimates vary, sources like the Bloomberg Billionaires Index and Forbes place Musk's total wealth between $385 billion and $436 billion. Less than half of this fortune currently comes from Tesla stock. The discrepancy in wealth estimates is partly tied to a disputed 2018 pay package, valued between $60 billion and $100 billion.

Jim Cramer's Perspective on Tesla's Identity

Jim Cramer of CNBC has consistently maintained that Tesla, Inc. (NASDAQ:TSLA) is fundamentally a technology company focused on autonomous driving and robotics, rather than a traditional car manufacturer. This perspective contrasts with the common perception of Tesla as solely an automotive company. Cramer believes that Elon Musk is uniquely positioned to scale robot production.

In response to a recent 4% rise in Tesla's share price without any obvious news, Cramer reiterated his stance. He also speculated about potential insider trading activity linked to the share price increase, humorously suggesting the possibility of an upcoming investigation into options purchases. He has been quoted saying, “[On shares being up 4% without any discernible news] Well, people are recognizing it for it really is. It’s autonomous driving, and it is robots."

Visit the website

Visit the website