A decision by Japan’s $1.8 trillion pension fund, the world’s biggest, to consider a shift into impact investing has triggered a wider adjustment among the country’s money managers.

The Government Pension Investment Fund opened the door to impact strategies in March and at least four other Japanese pension funds are updating or revising their investment policies, according to a review of the funds’ investment policies. At the same time, there’s evidence that asset managers pitching for pension mandates are now adjusting their approach to match growing demand for impact strategies.

Most Read from Bloomberg

The ripple effect through Japan’s $5 trillion money management industry is backed by the government, which has identified the strategy as a way to help address some of the country’s real-world challenges. That’s as policymakers in Japan face a rapidly aging society and one which ranked 118th last year in a gender-equality review of 146 countries.

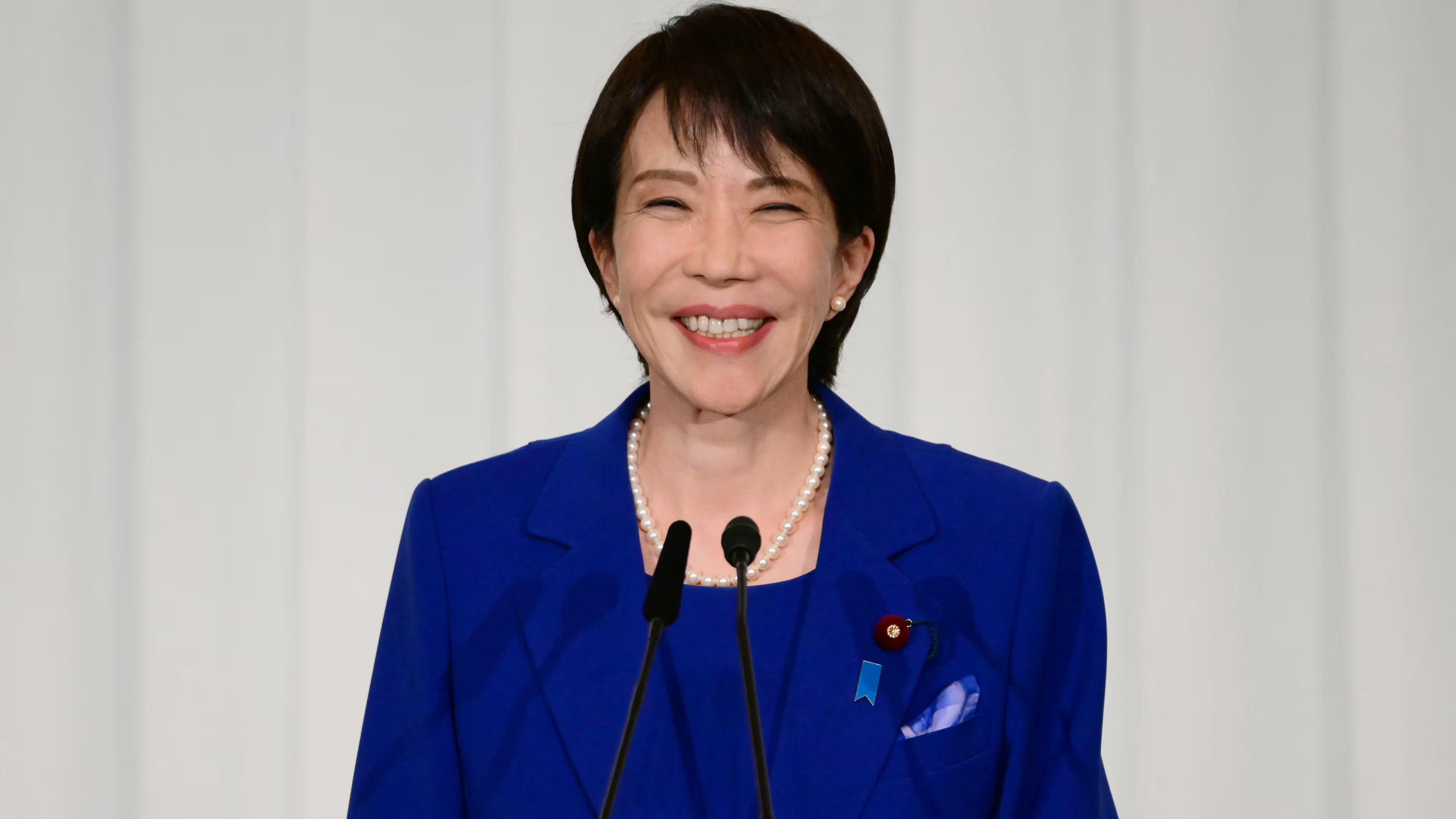

GPIF President Kazuto Uchida has made clear he thinks that an investment approach targeting environmental and social goals “ultimately leads to” economic and capital markets growth.

Kazuto UchidaPhotographer: Kentaro Takahashi/Bloomberg

Aniket Shah, managing director and global head of sustainability and transition strategy at Jefferies Financial Group Inc., says the fact that investors can measure the real-world effect of impact investing gives it the potential to be more powerful than basic screening for ESG (environmental, social and governance) risk.

“It’s more durable because looking at impact as a driver of growth of companies is a financial discussion,” Shah said. “This is a real economic theme and driver today.”

In Japan, impact investing strategies are likely to center around climate, health care, wellbeing and inclusivity, according to Masato Nakamura, head of GLIN Impact Capital, a Tokyo-based investment firm that participated in meetings with GPIF and other Japanese pensions about the strategy. The expectation is that GPIF will start applying the strategy to listed equities first, he said.

Impact investing targets both profit as well as social and/or environmental outcomes. The strategy typically uses a framework that standardizes impact measurement for investments. Major guidelines use the United Nations’ 17 Sustainable Development Goals as a roadmap to deploy capital.

[SRC] https://finance.yahoo.com/news/world-biggest-pension-fund-puts-152422314.html

Visit the website

Visit the website