Tesla (TSLA): Analyzing the Trending Stock Before Investing

**Tesla, Inc. (TSLA)** has garnered significant attention recently, appearing on Zacks.com's list of most searched stocks. This article examines key factors that could influence the electric car maker's stock performance in the near term, analyzing earnings estimate revisions and recent financial results to provide a balanced perspective.

Tesla's Recent Market Performance

Over the past month, **Tesla's** shares have increased by +9.9%, outperforming the Zacks S&P 500 composite's +3.4% change. The Zacks Automotive - Domestic industry, which includes Tesla, has gained 8.5% during the same period. Investors are keen to understand where this trending stock is headed.

Earnings Estimate Revisions and Zacks Rank

Zacks prioritizes evaluating changes in a company's earnings projections. Rising earnings estimates typically lead to a higher fair value for the stock and increased investor demand. For the current quarter, **Tesla** is expected to post earnings of $0.48 per share, representing a year-over-year change of -33.3%. However, over the last 30 days, the Zacks Consensus Estimate has changed +3.9%. The current fiscal year consensus earnings estimate of $1.66 points to a change of -31.4% from the prior year. The estimate has changed -0.4% over the last 30 days. The Zacks Rank for Tesla is currently #4 (Sell).

Tesla's Stock Performance in 2025 and Key Challenges

Despite recent excitement surrounding autonomy and energy storage, **Tesla (NASDAQ: TSLA)** shares are down about 14% so far in 2025. The company faces challenges in its core automotive business, with vehicle sales struggling and profitability relying on a lower-margin mix and regulatory credits. Management is heavily investing in autonomy, energy, and robotics, but commercialization timelines and profitability remain unproven. With a market value of roughly $1.1 trillion, the stock assumes significant future success.

Analyzing Recent Financial Results

Tesla's second-quarter filing reveals a decline in key metrics. Total revenue was $22.5 billion, down 12% year over year, with total gross margin at 17.2% versus 18% a year ago. Automotive gross margin fell to 17.2% from 18.5%, attributed to lower average selling prices and fewer regulatory credits. While the energy segment showed improvement, its current size is insufficient to offset the pressure in the automotive sector. Vehicle deliveries in the second quarter totaled 384,122, down from approximately 444,000 in the year-ago period.

Tesla's Roadmap and Execution Risks

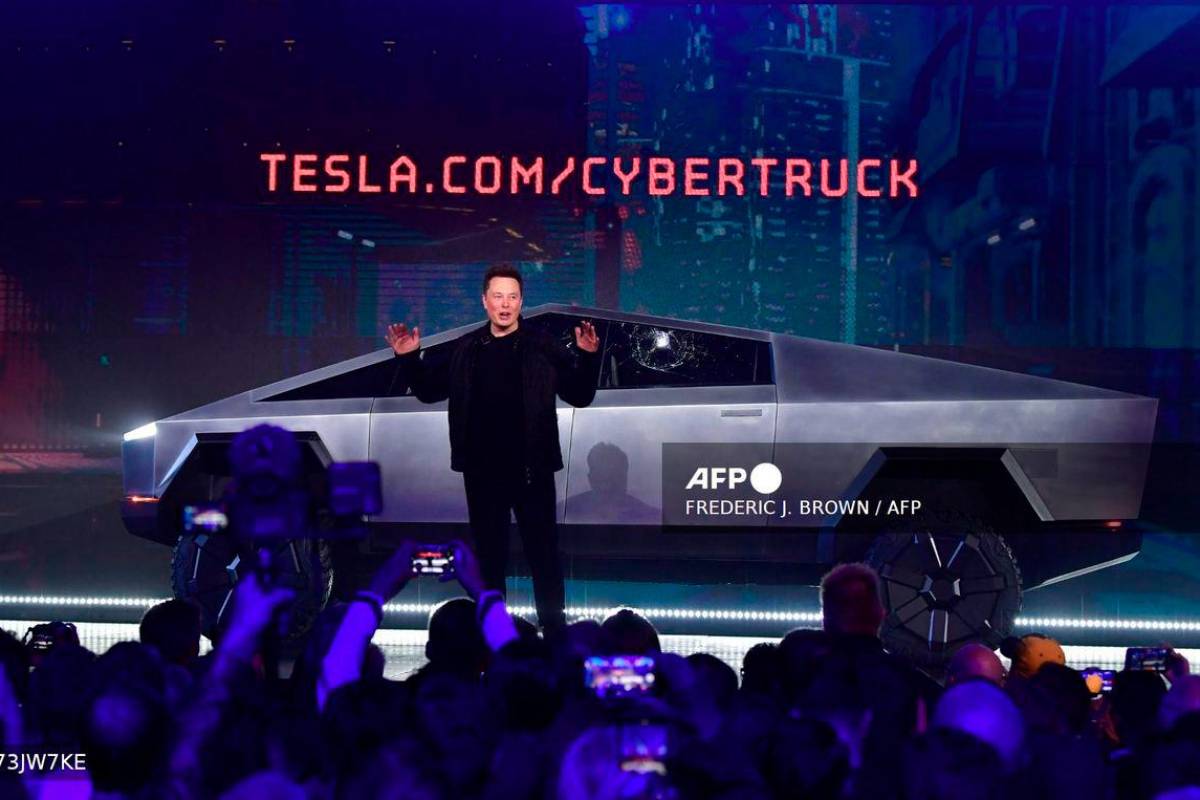

CEO **Elon Musk** characterized the current period as a "weird transition period," anticipating potentially "rough quarters." He outlined ambitious plans for a Robotaxi service, aiming to cover "probably half the population of the U.S. by the end of the year," pending regulatory approvals. Tesla is also expanding its energy storage business and exploring humanoid robotics, with potential factory deployment as early as late 2025. However, volume production, unit economics, and customer adoption remain unproven.

The Verdict on Tesla's Stock

While **Tesla** is undeniably innovative, its near-term performance hinges on the automotive business. Deliveries are down year over year, automotive margins have decreased, and the autonomy/ride-hailing effort remains in the pilot phase, facing regulatory constraints. The stock's valuation of $1.1 trillion reflects substantial optimism regarding autonomy, energy, or both. A more compelling investment case would require evidence of Tesla regaining market share in vehicles, stabilizing margins, or achieving quantifiable progress in monetizing autonomy at scale. For investors who don't own the stock, patience may be the best approach; for those who do, monitoring deliveries, automotive margins, and autonomy milestones is crucial.

Potential Double Down Opportunity?

Analysts are identifying potential "Double Down" stock recommendations for companies poised for significant growth. Past recommendations, such as Nvidia, Apple, and Netflix, have yielded substantial returns for investors. Currently, "Double Down" alerts are being issued for three companies, presenting potential investment opportunities. These are available to Stock Advisor members.

Visit the website

Visit the website