Canada's Rising Debt: An Unsustainable Trajectory?

The federal government's fiscal watchdog, the Parliamentary Budget Officer (PBO), has raised concerns about the long-term sustainability of Canada's debt. Interim PBO Jason Jacques used the word "unsustainable" to describe the current debt trajectory, signaling a potential fiscal challenge for the country.

PBO's Warning and Debt Projections

The PBO's report highlights that federal deficits are projected to remain above $60 billion in the coming years, raising concerns about the long-term sustainability of current fiscal policy. The report projects that net federal debt as a percentage of gross domestic product will rise to 43.7 per cent by 2029, a 4.5 percentage point increase from previous projections. While this figure alone isn't alarming, the trend of rising debt over time is a cause for concern.

The rising debt burden contrasts with earlier expectations of debt reduction through economic growth. Events like the invasion of Ukraine by Vladimir Putin and the potential re-election of Donald Trump have pressured Canada to increase defense spending, exacerbating the fiscal situation.

The Metaphor of the Hairpin Curve

Mr. Jacques uses the metaphor of a car speeding toward a hairpin curve to illustrate Canada's fiscal situation. There is time to adjust, but continued inaction risks a fiscal crisis. While Canada's credit rating remains solid and bond markets haven't significantly increased borrowing costs, future projections indicate a potential problem. The PBO projects a sharp increase in debt servicing costs through the next decade.

Rising Debt Servicing Costs

By fiscal year 2031, nearly 14 cents of every dollar in revenue will go to debt servicing, according to the PBO. This projection doesn't include potential increases in defense spending or the cost of Liberal election promises. A C.D. Howe Institute report projects an even higher debt burden in fiscal 2029 than the PBO forecast, further emphasizing the risk.

Debt as a Major Expenditure

By 2031, public debt charges are forecast to be Ottawa's second-largest single expenditure, second only to benefits paid to senior citizens. The PBO projects that the federal government will spend $82.4 billion on public debt charges within six years, more than triple the cost of debt servicing in fiscal 2019. From fiscal 2024 through fiscal 2031, debt servicing costs are expected to surge by 53.7%, surpassing the growth in elderly benefits.

Potential Solutions and the Need for Action

While Canada may not face an immediate debt crisis by 2031, the increased debt burden will make it more difficult to change fiscal direction. The article suggests a fiscal retrenchment in the upcoming budget, including significant cuts to the public service, reductions in business grants and subsidies, and a reworking of benefits to senior citizens. Delaying these actions will necessitate more drastic measures in the future.

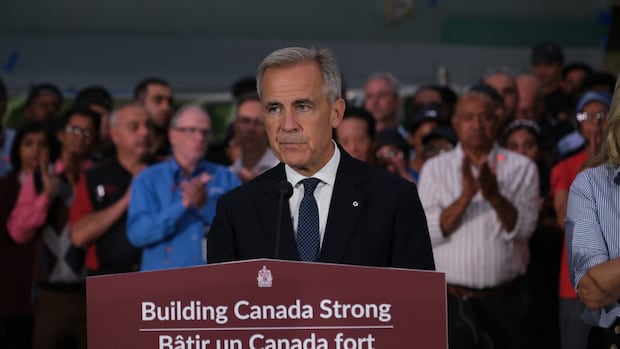

The Carney government's upcoming federal budget, slated for Nov. 4, will need to clarify how much new spending is prepared to be added to the already growing deficit. A more prudent approach might involve spending reallocations, as suggested by the Liberal platform.

"The closer you get to the hairpin curve, the harder you need to jam on the brakes – or else find the road disappearing under your wheels."

Visit the website

Visit the website