Tesla's Future: Robotaxis to Dominate Earnings, Says Ark Investment Management

**Tesla (TSLA)**, currently a leading electric vehicle (EV) manufacturer, faces increasing competition. While EV sales drive its financials, **Ark Investment Management**, led by **Cathie Wood**, predicts a significant shift: autonomous robotaxis could generate 86% of Tesla's earnings by 2029.

Ark's Bullish Prediction: Robotaxis Driving Tesla's Future

**Ark Investment Management** forecasts that **Tesla's** focus on autonomous vehicles will dramatically alter its revenue streams. They anticipate that self-driving robotaxis will contribute to a potential stock price of $2,600 by 2029, a substantial 615% increase from its current trading value. This prediction hinges on Tesla's successful transition from passenger EVs to a robust autonomous ride-hailing network.

Tesla's EV Business Faces Headwinds

This shift is potentially accelerated by challenges in **Tesla's** EV business. Despite delivering 1.79 million EVs in 2024, a 1% decrease year-over-year marked the first annual decline since the Model S launch in 2011. The situation worsened in the first half of 2025, with deliveries plummeting by 13%, leading to a 14% revenue decrease and a 31% decline in earnings per share (EPS).

Intensified competition from low-cost EV producers like **BYD** in **China** significantly impacts **Tesla's** market share. For instance, Tesla's sales in **Europe** sank by 40% in July, even as overall EV registrations surged. BYD, conversely, experienced a remarkable 225% sales increase in the same region. Tesla's strategy involves launching a low-cost EV to remain competitive, but its impact won't be felt until next year.

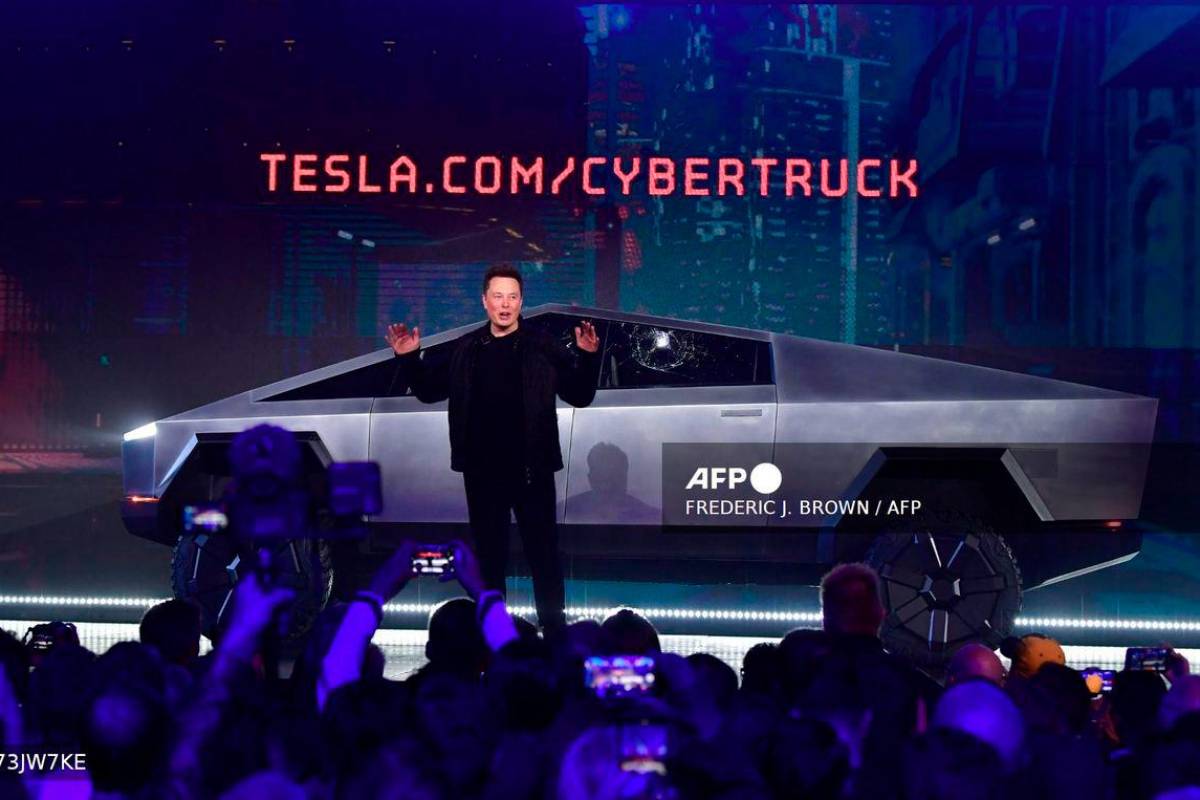

The Cybercab: Tesla's Robotaxi Vision

**Elon Musk** is heavily investing in autonomous ride-hailing, centered around the **Cybercab**, scheduled for mass production in 2026. The **Cybercab** will rely entirely on **Tesla's** full self-driving (FSD) software, aiming for operation without human intervention. This could generate substantial revenue by providing continuous passenger and commercial transport services.

Challenges and Competition in the Robotaxi Market

Scaling this autonomous ride-hailing business comes with significant challenges. Tesla's FSD software still lacks approval for unsupervised use in the **U.S.** Furthermore, **Tesla** faces competition from established ride-hailing giants like **Uber Technologies**, which already collaborates with numerous companies in the autonomous driving sector. Uber's extensive user base of around 180 million monthly users positions it strongly in the autonomous ride-hailing industry, a network Tesla must build from the ground up.

Ark's Optimistic Revenue Projections

Despite these challenges, **Ark** anticipates **Tesla** generating $1.2 trillion in annual revenue by 2029, with $756 billion stemming from its robotaxi platform. This could translate to $440 billion in earnings before interest, tax, depreciation, and amortization (EBITDA), with 86% attributed to the robotaxi due to its high profit margins, eliminating the cost of human drivers.

A Cautious Outlook on Tesla Stock

Despite **Ark's** optimistic outlook, their predictions might be overly ambitious. Current Wall Street estimates (via Yahoo! Finance) project Tesla's 2025 revenue at $93 billion. This implies a near 1,200% growth over four years to meet Ark's $1.2 trillion forecast, driven largely by a new robotaxi product. Tesla's current price-to-earnings (P/E) ratio of 209 is nearly seven times higher than the Nasdaq-100's P/E ratio of 31.6, making its valuation challenging to justify given its shrinking earnings.

Therefore, a 615% surge in **Tesla** stock to reach Ark's $2,600 target seems unlikely in such a short timeframe. While possible with a highly successful robotaxi platform, it's a difficult outcome to guarantee, considering Tesla's delayed delivery of unsupervised self-driving cars over the past decade.

Visit the website

Visit the website