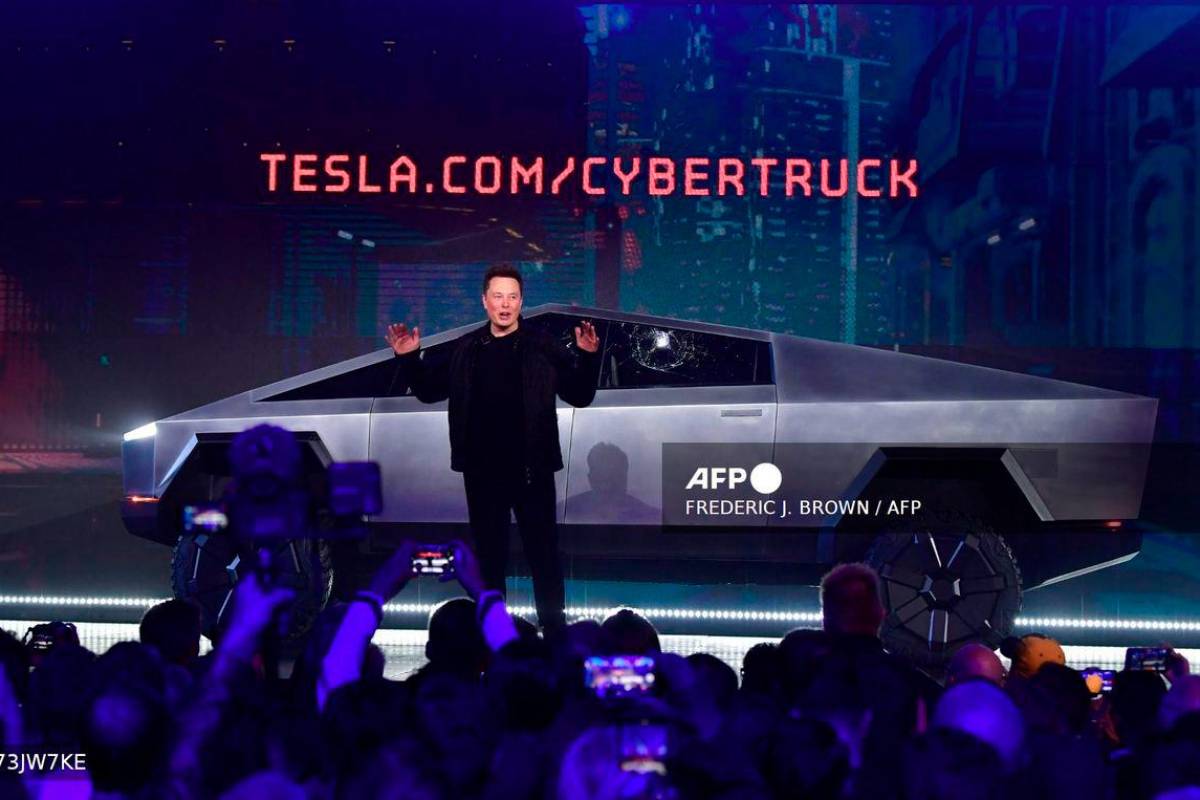

Tesla's Energy Strength and AI Potential: Analyst Weighs In

Tesla, Inc. (NASDAQ:TSLA) is drawing significant attention for its energy sector performance and burgeoning AI and robotaxi ambitions. Recent analyst reports highlight both the company's current strengths and potential future growth drivers. A mixed outlook persists, considering market performance and internal company dynamics.

Analyst Reaffirms "Peer Perform" Rating, Cites Energy Sector

Wolfe Research reaffirmed its "Peer Perform" rating for Tesla (TSLA), acknowledging the significant growth and profitability of the company's energy component. The analyst anticipates a 31% revenue increase, reaching $13.2 billion by 2025, with a gross margin of approximately 29%. While the automotive and AI/Autonomy sectors often dominate investor attention, the energy segment represents a substantial and profitable part of Tesla's business.

While acknowledging TSLA's potential, Wolfe suggests that some other AI stocks might offer better risk-reward profiles, presenting a call for careful investment consideration.

Dan Ives Bullish on Tesla's AI and Robotaxi Business

Wedbush Securities analyst Dan Ives believes that Tesla's artificial intelligence and robotaxi initiatives could unlock at least $1 trillion in value. He stated that Tesla and Elon Musk are entering a crucial phase of growth driven by the AI revolution. Ives envisions the AI and autonomous opportunity to be worth at least $1 trillion for Tesla.

"We believe Tesla and Musk are heading into a very important chapter of their growth story as the AI revolution takes hold and the robotaxi opportunity is now a reality on the doorstep," Ives wrote on X, formerly Twitter. "We estimate the AI and autonomous opportunity is worth at least $1 trillion alone for Tesla."

Speculation about a potential merger between Tesla and xAI has also emerged, with SkyBridge Capital founder Anthony Scaramucci suggesting such a move "feels inevitable."

Delivery Expectations and Market Performance

Gary Black, managing partner at The Future Fund LLC, attributes Tesla's recent stock performance to expectations of exceeding Wall Street's third-quarter delivery forecasts. Black estimates Tesla will deliver 470,000 vehicles, significantly above the consensus of 432,000. These figures are expected to be aided by buyers rushing to take advantage of the expiring $7,500 EV tax credit. However, Tesla's performance is uneven across global markets. Sales in China experienced a decline in August, but early September saw a rebound. Rising vehicle prices have also impacted Tesla's market share in the U.S.

Skepticism on Autonomy and Leadership

Not all analysts are convinced. Ross Gerber of Gerber Kawasaki, raised concerns about Tesla's approach to autonomy, citing potential hardware issues critical to self-driving safety. Criticism has also been directed at Elon Musk's leadership, with one ex-employee alleging it has negatively impacted Tesla's overall mission.

Stock Performance and Analyst Outlook

In July 2025, Tesla reported second-quarter revenue of $22.5 billion, below analyst estimates. While the company plans to launch a more affordable model in 2026, Tesla's stock performance has lagged behind the S&P 500 and Nasdaq 100 in 2025. The analyst consensus price target for TSLA is $311.81. Benzinga's Edge Stock Rankings suggest ongoing strength for TSLA across various time horizons.

Visit the website

Visit the website