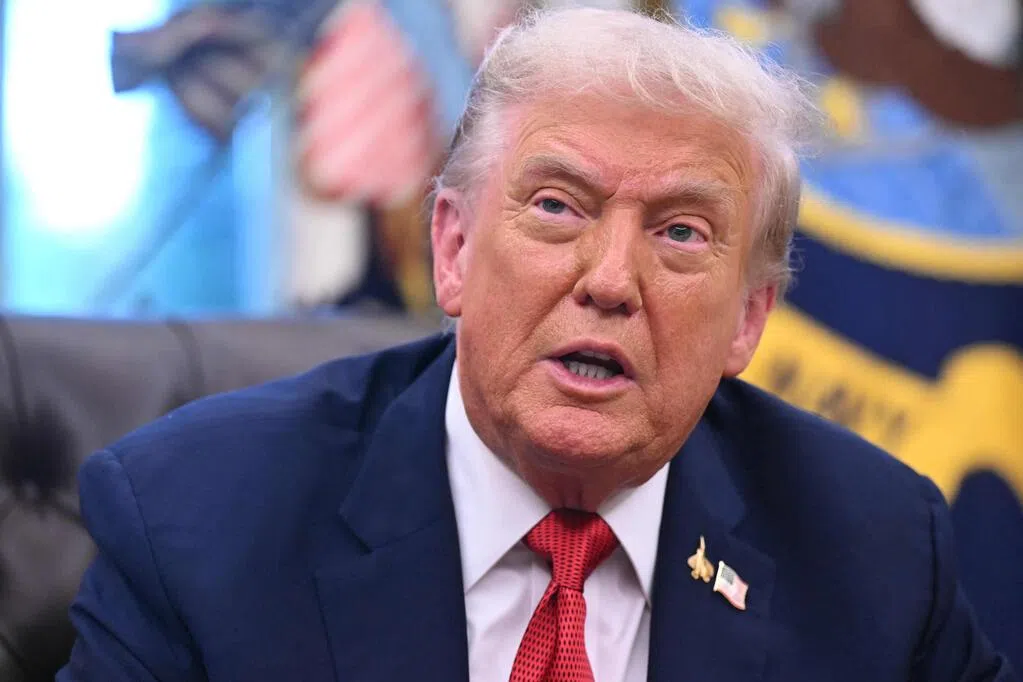

Trump Announces New Tariffs on Pharmaceuticals, Trucks, and More

Former U.S. President Donald Trump has announced a new round of tariffs targeting a range of imported goods, escalating trade tensions. The measures, set to take effect on various dates starting October 1st, will impact imported brand-name pharmaceuticals, heavy trucks, kitchen cabinets, and upholstered furniture.

Details of the New Tariffs

According to multiple reports, the tariffs include a 100% tariff on imported brand-name or patented pharmaceuticals, a 25% tariff on all imported heavy trucks starting October 1, 2025, and a 50% tariff on imported kitchen cabinets. Additionally, a 30% tariff will be imposed on imported upholstered furniture, starting next week from the announcement date.

Trump stated that the truck tariff is intended to protect American truck manufacturers from "unfair external competition," benefiting companies like Peterbilt, Kenworth, Freightliner, and Mack Trucks.

Rationale Behind the Tariffs

The rationale behind the pharmaceutical tariff, according to Trump, is to incentivize pharmaceutical companies to build manufacturing facilities in the United States. He claimed that the tariffs on kitchen, bathroom, and furniture products are due to a massive influx of imports, which harms American manufacturers. He accused other countries of "flooding" the U.S. with these products.

Market Reaction and Economic Impact

The announcement of these tariffs has already triggered a market reaction. Asian stocks fell amid concerns about high valuations and mixed signals from Federal Reserve officials regarding interest rates. Specifically, pharmaceutical stocks like Otsuka Pharmaceutical and Takeda Pharmaceutical experienced declines following the tariff announcement. Allspring Global Investment Portfolio Manager Gary Tan said that "Trump’s new pharmaceutical tariffs added to the headline risk for Asian equities into year-end".

Concerns around the potential impact of tariffs on the broader economy and the uncertain path of Federal Reserve policy are creating volatility. Strategists suggest the tariffs could pose challenges for assets in India and Europe.

Federal Reserve Perspectives on Interest Rates and Inflation

Several Federal Reserve officials have expressed differing views on interest rate policy. Stephen Miran argued for a swift interest rate cut to prevent economic damage, while Michelle Bowman suggested that inflation is nearing the Fed's target, supporting further rate cuts. However, Austan Goolsbee voiced concerns about tariff-driven inflation and opposed preemptive rate cuts, and Jeff Schmid indicated that the Fed may not need to cut rates again soon.

Upcoming Economic Data and Market Expectations

Investors are now focusing on the upcoming PCE inflation report. The market anticipates a slight downward trajectory which may allow the policy makers some leeway in addressing issues related to the employment sector. There is now increased speculation that the Federal Reserve may need to consider modernizing its interest rate targeting system. According to CME's "FedWatch", the probability of a 25-basis-point rate cut in October is 85.5%.

Visit the website

Visit the website