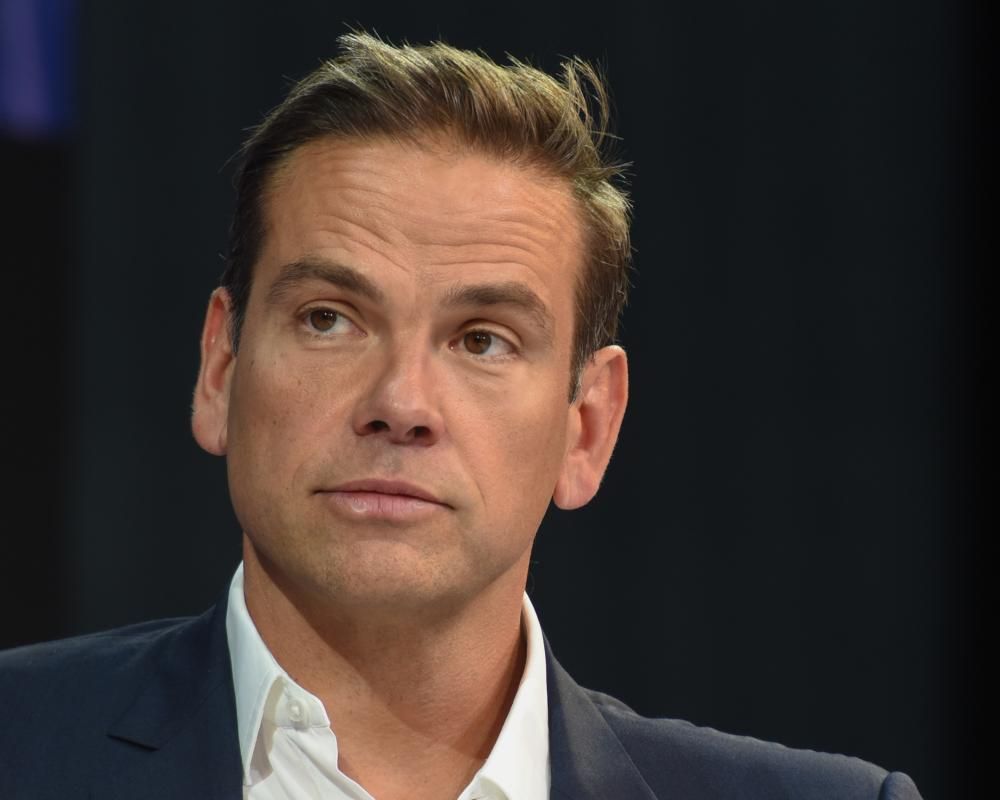

Lachlan Murdoch Takes the Reins: Shaping the Future of Fox and News Corp.

Lachlan Murdoch is solidifying his control over Fox Corp. and News Corp. after a resolution with his siblings regarding the family trust. This marks a new chapter for the media empire built by his father, Rupert Murdoch, with Lachlan poised to lead the companies into an increasingly digital future.

The Family Settlement and Lachlan's Increased Control

Following a challenge in Nevada probate court by his siblings Prudence, Elisabeth, and James Murdoch regarding amendments to the family trust intended to concentrate power with Rupert's preferred heir, a settlement was reached. The siblings agreed to dissolve the trust in exchange for a $1.1 billion payout each. This deal effectively paves the way for Lachlan to exert greater control. He now controls roughly a third of both Fox Corp. and News Corp. voting shares.

To finance the buyout of his siblings, Lachlan, along with siblings Grace and Chloe Murdoch, established a holding company, LGC HoldCo, and borrowed $1 billion from JPMorgan Chase. Furthermore, a third of the $3.3 billion total is being financed by the sale of Fox Corp. and News Corp. Class B shares, exposing Lachlan to significant financial risk tied to the performance of these companies.

Rupert Murdoch's Legacy and Lachlan's Inheritance

Rupert Murdoch transformed a chain of Australian newspapers, inherited in 1952, into a $43 billion global media powerhouse. Today, Fox Corp.’s market cap is $25.4 billion, and News Corp.’s is $17.7 billion (as of Friday). Key assets include Fox News, Fox Sports, and major publications like The Wall Street Journal and The Times.

Rupert semi-retired in 2023, with Lachlan assuming more responsibility. While the family trust initially stipulated equal division of voting shares among Rupert's four eldest children and equal equity stakes for all six, the recent settlement significantly alters this dynamic, positioning Lachlan as the dominant figure.

Lachlan Murdoch: A Digital Dealmaker

While Lachlan Murdoch inherits a mature media empire, he's demonstrated a knack for navigating the digital landscape. One of his most successful ventures was a $10 million investment in REA Group in 2000, which has since become an online real estate advertising giant. News Corp.'s stake in REA is now worth over $18 billion.

- 2019: Led Fox Corp.'s acquisition of a majority stake in fintech Credible.

- 2020: Led Fox Corp.'s acquisition of the streaming service Tubi for $440 million, which now has over 100 million monthly users.

Challenges and Opportunities

Lachlan's tenure hasn't been without its challenges. News Corp. faced a $13 million settlement related to One.Tel's collapse in 2001, and a bid to acquire Australian broadcaster Ten Network Holdings failed in 2017. Furthermore, News Corp. sold a stake in gambling startup Betr after its investment did not prove successful.

Financial Performance and Future Outlook

Recent financial results indicate strong performance at both Fox Corp. and News Corp. Fox Corp. reported a 7% jump in advertising revenue and attributed growth to Tubi and Fox News. News Corp. exceeded analysts’ expectations, driven by surging digital subscriptions at Dow Jones and growth in its digital real estate unit. News Corp. CFO Lavanya Chandrasekar has said that the company's “current share price is at a significant discount to net asset value.” JPMorgan and Citigroup rate the stock a buy, with a $40 target price.

While a potential merger between Fox Corp. and News Corp. was explored in 2022 and later deemed "not optimal," the focus remains on unlocking value from the existing assets. Rupert Murdoch started with a chain of Aussie papers; Lachlan now faces the challenge of maximizing the potential of a global empire.

Visit the website

Visit the website